An Unearned Revenue Can Best Be Described as an Amount

B and not reported on the income statement. Small businesses receive unearned revenue when a client pays for goods or services before the business sends the goods or performs the service.

Types Of Adjusting Entries In Accounting Process Accounting Education Accounting Books Accounting Basics

Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

. D collected and not reported on the income statement. What is the most likely reason for this. So it is that amount which is collected and presently not matched with that expense.

Unearned revenue can best be described as an amount collected and currently matched with expenses. Accrued revenue refers to the revenues which have been recognized or earned by the company or an organization but these revenues are not yet billed to the customer. The term REVENUEcan be best describe as an unearned income.

At that point its balance sheet will report the remaining liability in. Up to 20 cash back 1 An accrued expense can best be described as an amount Author. Not collected and not currently matched with expense Collected and currently matched with.

Unearned revenue sometimes referred to as deferred revenue Deferred Revenue Deferred revenue is generated when a company receives payment for goods andor services that it has not yet earned. Hence the correct option is B. D not collected and not currently matched with expenses.

Unearned revenue on the books of one company is likely to be. Unearned revenue can also be defined as prepayment customer deposits advanced payment or deferred revenue. An unearned revenue can best be described as an amount A collected and currently matched with expenses.

The unearned revenue is the revenue which collected from the customer but has not been performed yet by the firm. Debit Interest Receivable and credit Interest Revenue Debit Cash and credit Interest Receivable 800. An unearned revenue can best be described as an amount.

Hand writing ko guys maganda ba haha use the pronoun in each in a sentence. Therefore earning of that revenue will cause a. An unearned revenue can best be described as an amount.

A prepaid expense on the books of the company that made the advance payment b an unearned revenue on the books of the company that made the advance payment. An unearned revenue can best be described as an amount a. Paid and not currently matched with earnings.

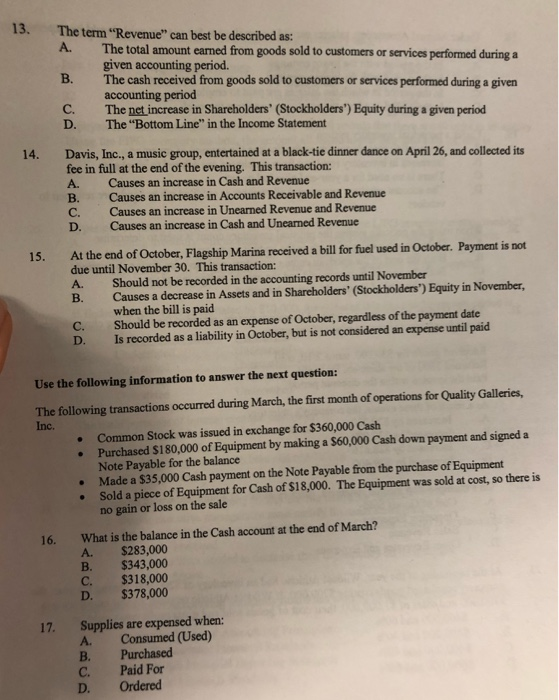

A collected and currently matched with expenses b collected and. Unearned revenue can best be described as an amount collected and currently matched with expenses. The amount that is received in advance is recorded as an unearned revenue on the liability side of the balance sheet.

In accrual accounting is payment received by a company from a customer for products or services that will be delivered at some point in the future. Accounting questions and answers. A legal retainer paid in advance.

Debit Interest Receivable and credit Interest Revenue Debit Cash and credit Interest Revenue 200. The comparative balance sheet indicates Unearned Consulting Fees of 52500 at the beginning of the year and 45000 at the end of the year respectively. The Income Statement of a Company showed Revenues Earned from Consulting Fees totaling 180000 during the current year.

If the Direct Method is used to prepare the statement of Cash. Accrued income is described as an amount which is not collected but has matched with related expenses recently. An unearned income can best be described as an amount Collected and currently matched with expenses.

A rent payment made in advance. Collected and currently matched with expenses. An unearned income can best be described as an amount - 17409650 jehcute9860 jehcute9860 04082021 English.

Asked Apr 13 2021 in Business by. Advertisement Advertisement New questions in English. An accrued revenue can best be described as an amount a and reported on the income statement.

C collected and reported on the income statement. Its considered a liability or an amount a business owes. Debit Cash and credit Unearned Rent.

Its categorized as a current liability on a businesss balance sheet a common financial statement in accounting. Examples of unearned revenue are. C not collected and currently matched with expenses.

A services contract paid in advance. Not collected and currently matched with expenses. An unearned revenue can best be described as an amount a.

Debit Unearned Rent Revenue and credit Rent Revenue P10000. Collected and currently matched with expenses. Not paid and currently matched with earnings.

Not paid and not currently matched with earnings. Accounting for Unearned Revenue. When an item of revenue or expense has been earned or incurred but not yet collected or paid it is normally called an _____ revenue or expense.

When Chris receives the check he is surprised to find that its made out for less than the amount of unearned premium he should have received. An unearned revenue can best be described as an amount A collected and currently matched with expenses. Once it provides the first lawn service it will record a debit to its unearned revenue account in the amount of 40.

B collected and not currently matched with expenses. 5 An accrued expense can best be described as an amount. Examples of Unearned Revenue.

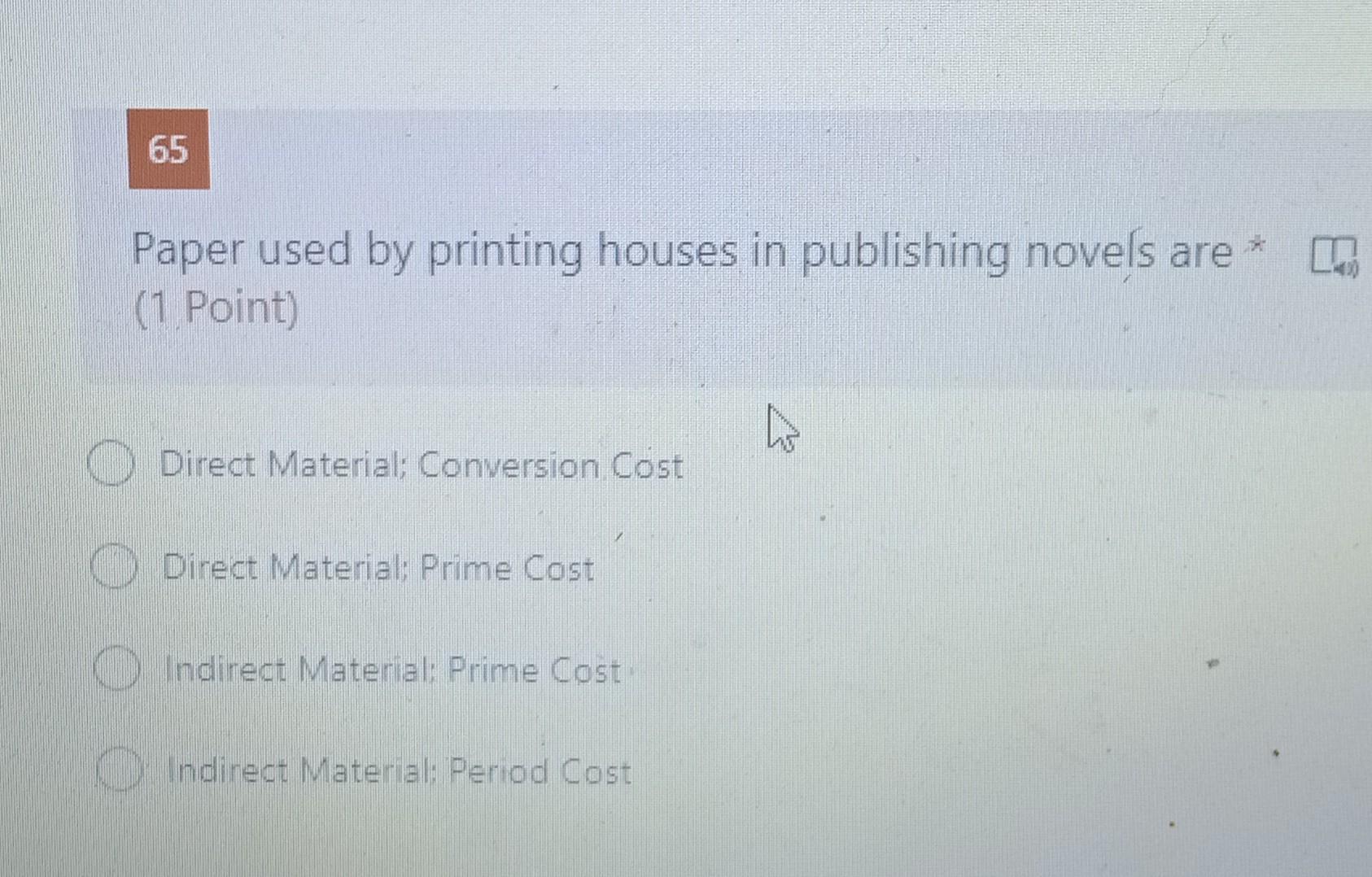

Marked out of 100 An unearned revenue can best be described as an amount Select one. An unearned income can best be described as an amount Collected and currently matched with expenses O Not collected and currently matched with expenses O Not collected and not currently matched with expenses O Collected and not currently. Asked May 9 2021 in Business by Android.

Solution for Unearned revenue can be best be described as an amount. We he she I.

Solved 13 The Term Revenue Can Best Be Described As A Chegg Com

Solved 63 An Unearned Revenue Can Best Be Described As An Chegg Com

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Comments

Post a Comment